There are three types of FX trading methods: “market orders” (成行注文), “limit order” (指値注文), and “stop order” (逆指値注文). Understanding the differences between these can prevent issues like unintended trades or missed trading opportunities. Since you’re handling important money, let’s understand the basic methods of placing orders.

Differences between Market Orders and Limit Orders

The difference between a market order and a limit order

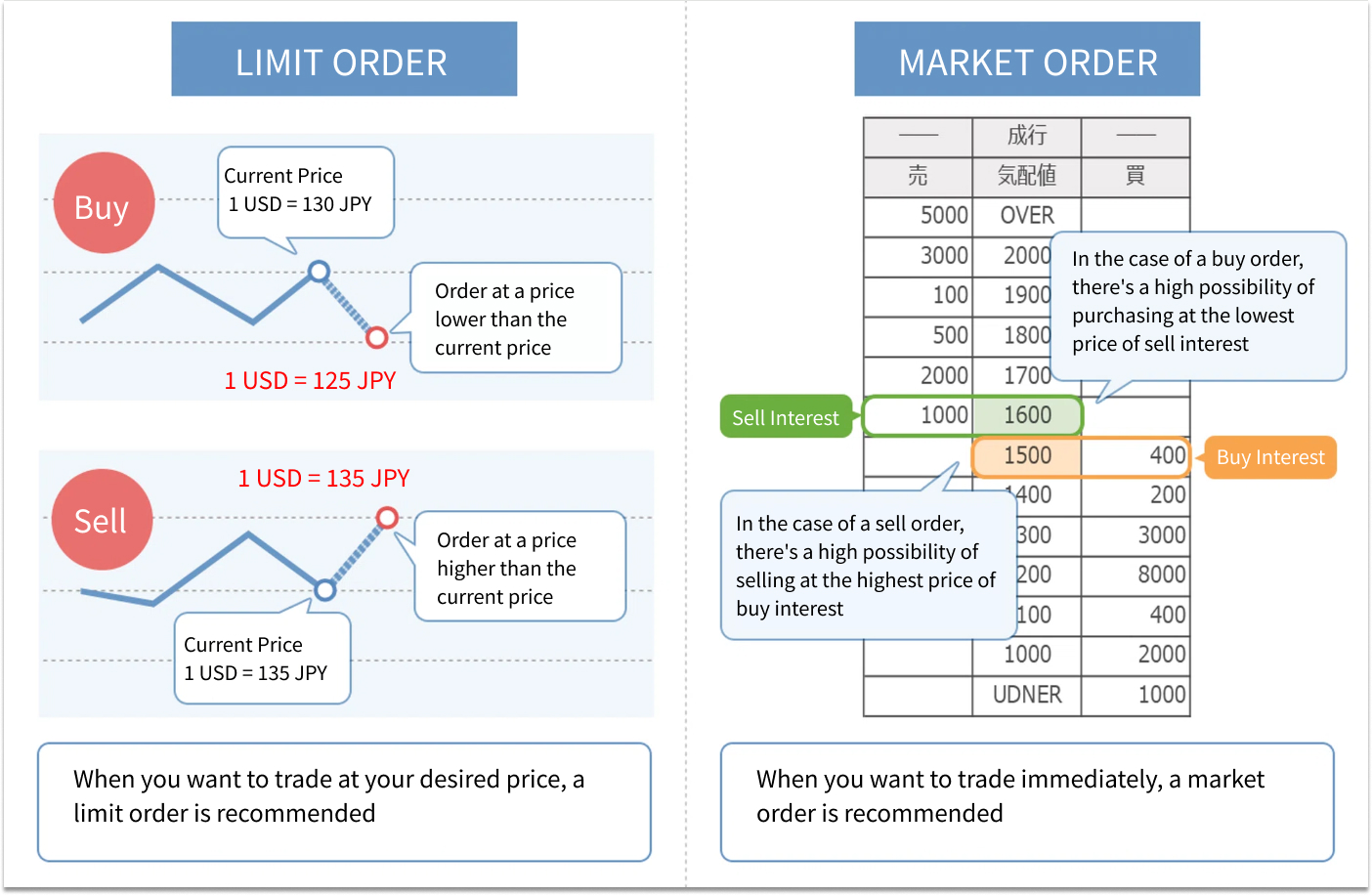

The difference between a market order and a limit order lies in whether you set the price for the currency pair you wish to trade.

Market Order

“Limit Order” allows you to specify a desired price, and the trade is executed at that price.

For example, if you want to trade at 1 dollar = 110 yen, a limit order allows you to execute at that price.

“Market Order” is executed at the current market price.

With a market order, the trade occurs immediately at the price offered by the FX broker.

Advantages and Disadvantages of Market Orders

The biggest advantage of market orders

is that the transaction is completed quickly. Because it’s executed at the market price immediately, you can respond to sudden price fluctuations. For example, market orders are effective when you want to react quickly to major economic news.

The disadvantage of market orders

is that the execution price is unpredictable. If market liquidity is low, the trade might execute at a price more unfavorable than expected. For example, even if the current price is 1 dollar = 110 yen, it might execute at 1 dollar = 111 yen if liquidity is low.

Advantages and Disadvantages of Limit Orders

The advantage of limit orders

is that you can trade at your desired price. Since the trade executes at the specified price, you can minimize losses or secure profits. For example, if you want to buy at 1 dollar = 109 yen, a limit order allows you to execute at that price.

The disadvantage of limit orders

is that if the market never reaches the specified price, the trade will not execute.

What is a Stop Order?

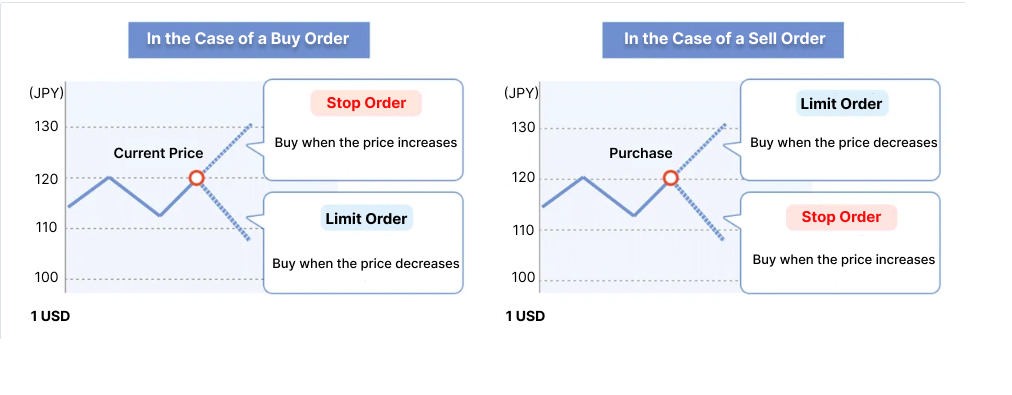

A stop order is a method of trading when the price reaches a specified level. For example, “sell if 1 dollar drops below 108 yen” or “buy if 1 dollar exceeds 112 yen”.

Using this order method can reduce the risk of missing trading opportunities or expanding losses. Even busy people can trade without worrying about market movements.

Difference between Stop Orders and Limit Orders

Stop Order: This order type becomes active when a certain price is reached, leading to either a market or limit order execution. It is useful for minimizing losses or trading with the trend.

Limit Order: Executes a trade at your specified price or better. This order type is used to secure a more favorable trading position.

The difference between a stop order and a limit order

Summary

Understanding the basic FX order types—market, limit, and stop orders—and their respective features is crucial for efficient and risk-managed trading. Knowing the advantages and disadvantages of each order type helps in choosing the right one according to the situation.